Let me start by saying that I consider myself a very responsible credit card user. I never spend more than I have and I always pay off my card in full each month. (Thanks for the good advice, Dad!) So, my current issues with CitiBank aren’t related to increasing interest rates, or other issues like that. My real issue with CitiBank is the way they handle fraud and the amount of frustration and hassle they have caused me over the past few years. Let’s begin.

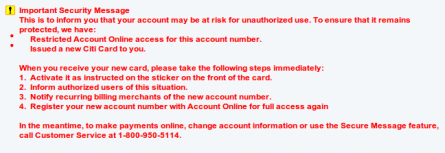

I logged into my Account Online this evening and discovered this daunting message on my homepage:

Welp, that’s never good. This has happened to me before and I suspected it was a similar cause. I decided to give CitiBank a call and promptly received friendly help. I was informed that a merchant’s (I assume one that I purchased from?) database was hacked and Citi decided to cancel all of the credit cards that recently purchased from that merchant. Mine was affected. Part of me is happy that they are taking a preventative approach to handling this security breach rather than waiting until my card was used fraudulently. I understand that CitiBank would be the one to suffer the consequences of a stolen card since I am not liable for a penny of stolen charges. It makes sense why they are so vigilant about these things, but as the customer, it causes me A LOT of pain.

First, I cannot make online transactions until my new credit card arrives in the mail. This could take up to a week. Next, all of my auto-pay transactions for bills will likely be blocked. I need to manually go to each of my bills and online shopping websites (there are a lot of them) and change my credit card settings. This entire scenario has happened to me before and it’s a major chore. Another issue that really leaves me puzzled is that CitiBank requires me to register an entirely new Account Online for my new card. This means that I must create a new username and password. I don’t understand why they cannot let me use my same account and activate the new card through this account. So silly.

I’ve experienced similar issues relating to CitiBank’s overly cautious fraud strategy a few months ago after graduation. I was traveling a lot and preparing to move to North Carolina. I was using my credit card more than usual and making a lot of charges online and in other states. On two occasions (within the same month) CitiBank locked out my card and didn’t tell me. I had to call the number on the back of the card and figure out what was going on. If you’re going to lock my card, at least send me an email or leave a voicemail in advance. This is no way to treat a customer.

Do other credit card companies treat customers this way? I’m not sure there’s much that can be done about it. It’s likely just heightened caution in this economy and very aggressive tactics to minimize the potential loss that they must incur each year from fraud.

</Rant>

Comments