Pictured Above: Mount Baker Ski Area, one of the best lift ticket values for the experience in North America.

We recently released a 2021-22 lift ticket pricing guide, which breaks down the variable pricing strategies employed by the ski resort industry and provides a general measure of expense for every resort for all age groups. Throughout the project, we’ve done extensive research on the pricing behavior from each resort and found some key trends on the ways prices are set.

Before we jump in, we want to caveat that this analysis was done on ski resorts that are designed for destination visitors. Consequently, it may not provide the best read on pricing behavior for local hills. Additionally, every separate area is considered as its own mountain for the purposes of this analysis; for example, Snowmass, Aspen Highlands, Aspen Mountain, and Buttermilk are considered independently despite being on the same ticket product.

Resort Ticket Prices Correlate with Mountain Scores—Mostly

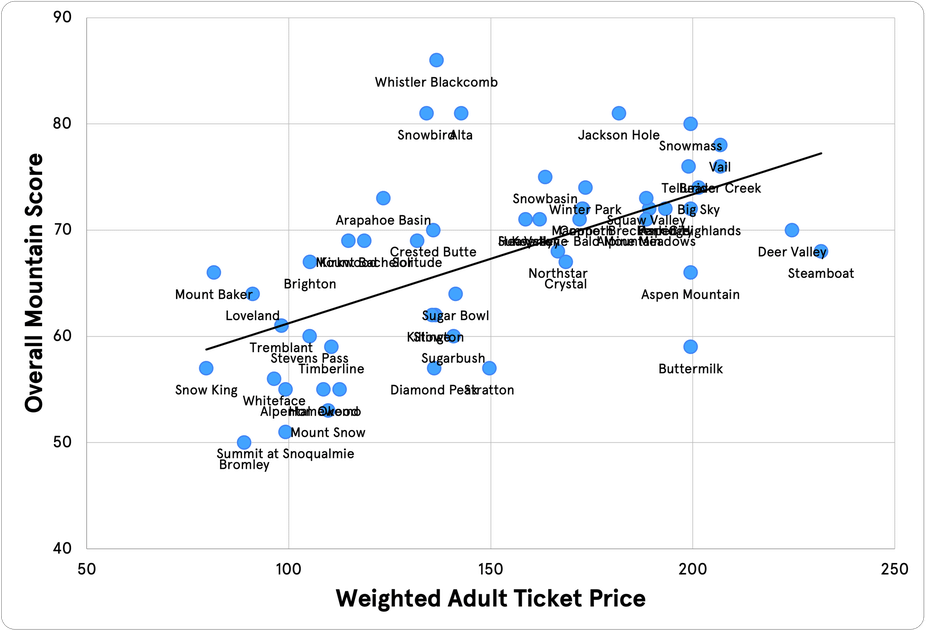

Resorts with higher prices generally see better PeakRankings Mountain Score ratings, with weighted adult ticket prices exhibiting a modest correlation to resort overall experiences. Whistler Blackcomb and Buttermilk are the biggest outliers—Whistler Blackcomb visitors benefit from favorable American exchange rates (less consistent snow conditions than some other regions likely impact the pricing as well), while Buttermilk visitors must pay the full Aspen/Snowmass ticket price for access despite a considerably less impressive experience.

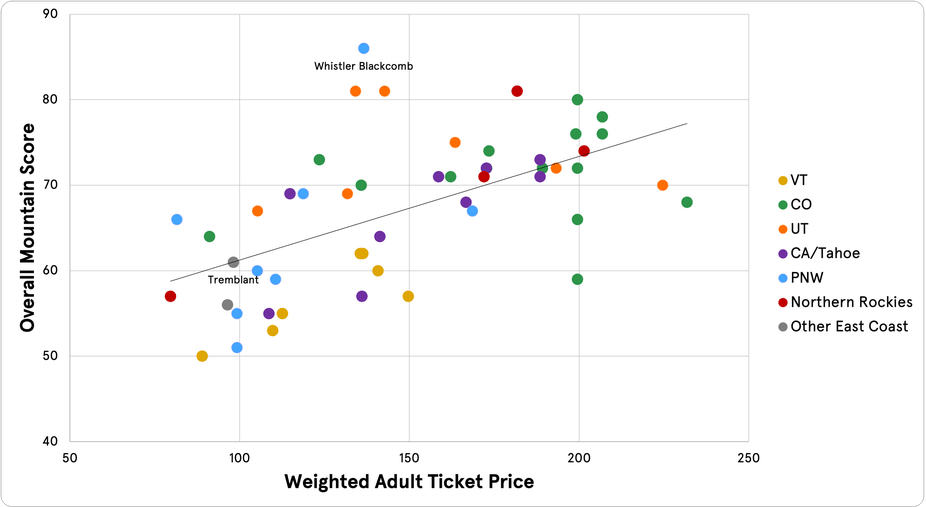

For the overall mountain experience alone, Colorado and Utah generally offer good values for the price. On the other hand, East Coast resorts command more of a premium for their experiences. A considerable portion of the skiing population lives within driving distance of the East Coast but must shell out a pretty penny to fly to the Rockies, plausibly allowing Eastern resorts to jack up their ticket prices to account for the ease of access. The only East Coast resort that offers a decent value by these metrics is Tremblant, which, like Whistler, benefits from favorable Canadian exchange rates.

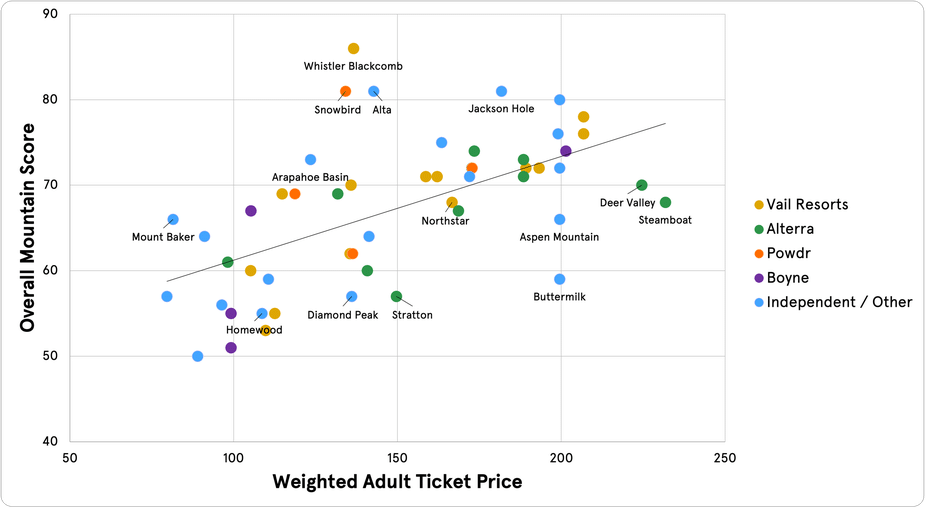

Very few people will be surprised to learn the best values can often be found at independent mountains. Four out the six best resort values based on our methodology—Alta, Jackson Hole, Arapahoe Basin, and Mount Baker—are independently owned. However, some independently-owned resorts, such as Diamond Peak, Homewood, Aspen Mountain, and Buttermilk, offer poor values for the price.

Despite their reputation for aggressive pricing, Vail Resorts mountains generally offer a decent value for what you get (at least for the Rockies and the West Coast). Vail-owned areas are mostly priced in order of our rankings—the key outliers are Whistler, which outscores seven pricier sister mountains, and Northstar, which is more expensive than its higher-scoring Heavenly and Kirkwood neighbors.

Of the large resort companies, Alterra generally commands the largest premium for the experience. Some resorts, such as Tremblant, Winter Park, Solitude, and the Palisades Tahoe duo, offer decent values, but Deer Valley, Steamboat, and Stratton—all of which command the highest ticket prices in their respective regions despite lower Mountain Scores than many competitors—are among the worst values.

Many Resorts Adjust Prices on a “Days In Advance” Basis—Only a Few Use Truly Demand-Based Pricing

It’s not exactly easy to shop around for Vail Resorts tickets across different days (their UI only shows one date at a time), but all Vail mountains follow a similar pattern, with the best advanced purchase pricing more than 7 days in advance, then less of a discount 1-6 days in advance, then window ticket prices the day of. Their child/senior/teen ticket prices have a linear relationship to the adult tickets, meaning purchasers will get the same discount from the adult rate no matter when you buy, save one exception (Okemo’s day-of child tickets are the same price as adult tickets).

While not always as streamlined as Vail Resorts’ strategy, other resorts exhibit similar behaviors, with price adjustments at the 14-day, 30-day, or even 60-day marks before the ticket date. Some independent resorts and a few Alterra, Powdr, and Boyne resorts do employ true demand-based pricing, raising prices for some or all days as more tickets get sold.

Prices See Adjustments for March

Depending on the region, ski resorts—especially those owned by Vail Resorts—see some sort of price variation in March. Some resorts in Vermont, California, and Washington see price drops on weekends when March hits, usually to weekday levels. However, many Colorado resorts as well as Utah’s Park City and Deer Valley see considerable price gains in March, often to holiday levels. This pricing practice likely maps to consumer demand, as many East Coast, Bay Area, and Pacific Northwest skiers opt to start the season out with drivable trips before graduating to one major fly-to vacation, as the Rockies is well-known for being.

A few resorts see their peak pricing set in February. Both Jackson Hole and Whistler Blackcomb charge a premium for skiing in that month; both of these mountain are well-known for extreme terrain that takes awhile to fill in and warmer springs (and in Whistler’s case, sporadic rain) that deteriorate the snow conditions.

See the full article on peakrankings.com: https://www.peakrankings.com/content/key-trends-in-ski-resort-lift-ticket-pricing/

Comments